jQuery(function($){ $(window).load(function () { window.onresize = function(){ location.reload(); } var mq = window.matchMedia( "(min-width: 1000px)" ); if (mq.matches) { function collage() { $('#gallery-1.FGM-Collage').removeWhitespace().collagePlus( { 'targetHeight' : 200, 'padding' : 0, 'allowPartialLastRow' : false } ); }; $(document).ready(function(){ collage(); }); var resizeTimer = null; $(window).bind('resize', function() { $('.FGM-Collage .fg-gallery-item').css("opacity", 0); if (resizeTimer) clearTimeout(resizeTimer); resizeTimer = setTimeout(collage, 200); }); } }); }); jQuery(function($){ $('#gallery-1.FGM-Collage').lightGallery({ mode:'slide', speed: 2000, thumbnail: true, controls: true }); });

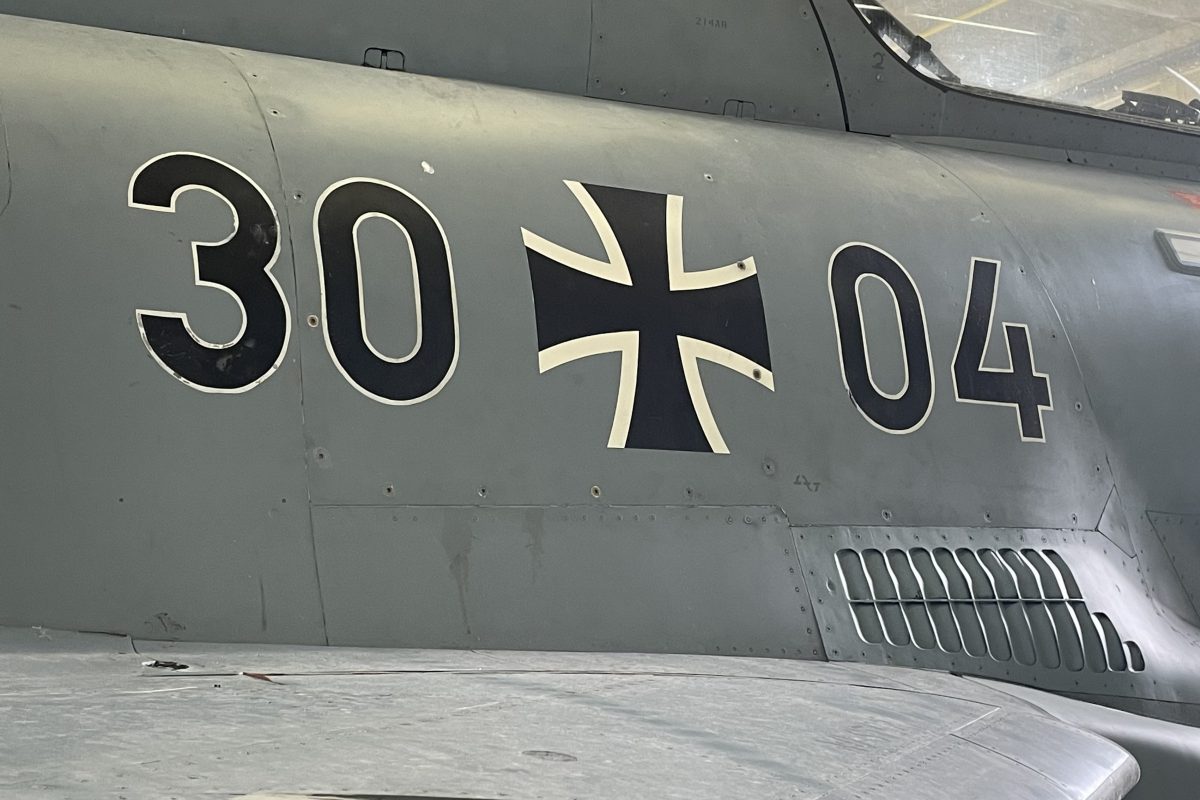

Der Eurofighter mit der Kennung 30+04 ist bereits der dritte Jet, den KMS Intermedia mit einer Sonderbemalung verziert hat. Die erste Sonderfolierung erfolgte 2016 auf dem Eurofighter mit der Kennung 30+90, anlässlich der Umstrukturierung der taktischen Luftwaffengruppe zu einem eigenständigen Geschwader. 2018 wurde das Dekor der 30+90 um einige Designelemente erweitert, um dem 100. Todestag von Manfred von Richthofen zu gedenken. Diese Sonderfolierung wurde über zwei Jahre hinweg beibehalten.

Im Jahr 2019 erhielt KMS Intermedia den Auftrag, einen weiteren Eurofighter mit einer Sonderbemalung zu versehen. Die Sonderfolierung Baron Spirit wurde anlässlich des 60-jährigen Jubiläums des Taktischen Luftwaffengeschwaders 71 “Richthofen” erstellt und auf dem Eurofighter 30+25 angebracht.

Die neueste Sonderfolierung auf dem Eurofighter 30+04 ist jedoch anders als die beiden vorherigen. Der Jet ist ein ausgemusterter Zweisitzer, der nun zu Ausbildungszwecken genutzt wird. Obwohl der Jet nicht mehr am ostfriesischen Himmel fliegen wird, wird er dennoch bei der Übung ELEPHANT RECOVERY zum Einsatz kommen.

KMS Intermedia ist seit vielen Jahren im Bereich der Flugzeugfolierung tätig und hat bereits zahlreiche Flugzeuge für verschiedene Kunden foliert. Besonders im Bereich der Sonderfolierungen für militärische Flugzeuge hat sich das Unternehmen einen Namen gemacht. Mit viel Kreativität und Know-how entstehen einzigartige Designs, die nicht nur optisch beeindrucken, sondern auch eine besondere Bedeutung haben können.

Die Folierung der Eurofighter für die Luftwaffe ist ein weiteres Beispiel für die hohe Qualität der Arbeit von KMS Intermedia. Die besonderen Designs unterstreichen die Bedeutung und Geschichte der betreffenden Flugzeuge und zeigen eindrucksvoll, was mit modernen Folierungstechniken alles möglich ist. Auch zukünftig wird KMS Intermedia sicherlich weitere Flugzeuge mit einzigartigen Designs versehen und so für Aufsehen sorgen.

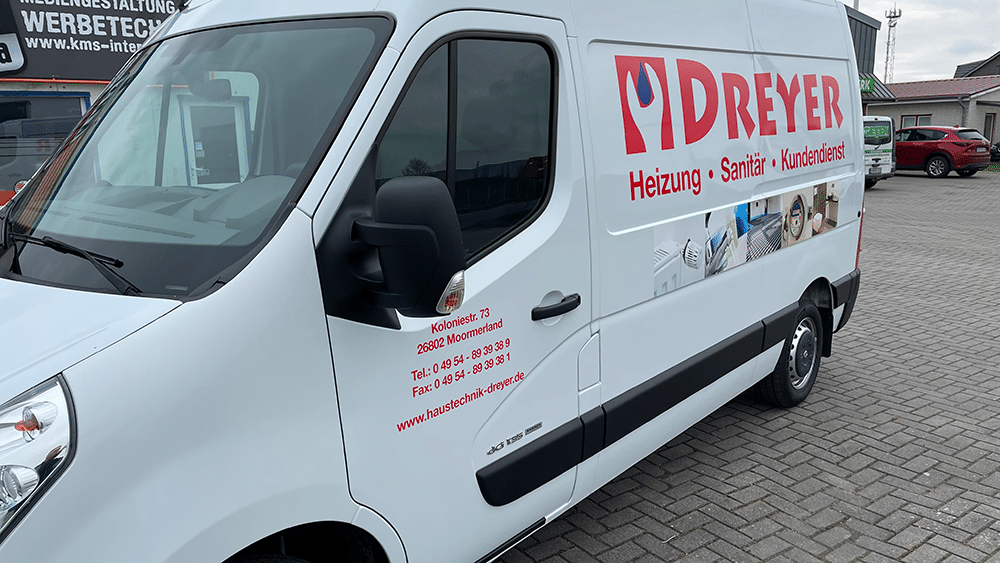

Die Firma Heizung-Sanitär Dreyer hat ihre Flotte erweitert und uns den Auftrag zur Beklebung des neuen Fahrzeugs gegeben. Mithilfe von hochwertigen Folienplots und Digitaldrucken haben wir die Werbung auf dem Fahrzeug angebracht.

Die Firma Heizung-Sanitär Dreyer hat ihre Flotte erweitert und uns den Auftrag zur Beklebung des neuen Fahrzeugs gegeben. Mithilfe von hochwertigen Folienplots und Digitaldrucken haben wir die Werbung auf dem Fahrzeug angebracht.

Die Firma Kruse Fensterbau hat kürzlich ihre neue Berufsbekleidung erhalten und ist begeistert von dem Ergebnis. Die Kleidung wurde von uns fachmännisch bedruckt und individuell an die Bedürfnisse des Unternehmens angepasst.

Die Firma Kruse Fensterbau hat kürzlich ihre neue Berufsbekleidung erhalten und ist begeistert von dem Ergebnis. Die Kleidung wurde von uns fachmännisch bedruckt und individuell an die Bedürfnisse des Unternehmens angepasst.

Am Großen Meer gibt es ab sofort ein neues Leitsystem für den 3-Meere-Weg, das Wanderern und Touristen eine noch bessere Orientierung bietet. Der neue Werbepylon besteht aus drei Seiten und beinhaltet Infotafeln, die den Besuchern nützliche Informationen zu dem Gebiet liefern.

Am Großen Meer gibt es ab sofort ein neues Leitsystem für den 3-Meere-Weg, das Wanderern und Touristen eine noch bessere Orientierung bietet. Der neue Werbepylon besteht aus drei Seiten und beinhaltet Infotafeln, die den Besuchern nützliche Informationen zu dem Gebiet liefern.